Get the free pan card form 49a filled sample pdf

Show details

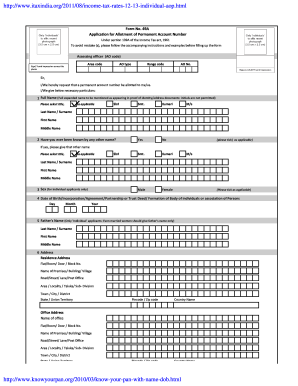

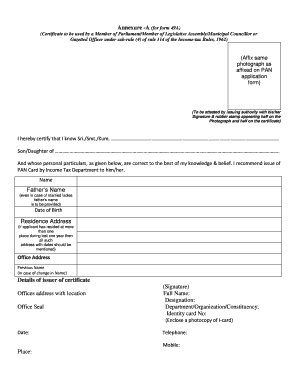

Form No. 49A Application for Allotment of Permanent Account Number Under Section 139A of the Income Tax Act 1961 To avoid mistake s please follow the accompanying instructions and examples carefully before filling up the form To Area Code The Assessing Officer AO Type Range Only Individuals to affix recent photograph 3. 5 cm x 2. 5 cm No* Ward/ Circle Commissioner Sir I/We hereby request that a permanent account number be allotted to me/us. I/We give below necessary particulars Signature/...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your pan card form 49a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pan card form 49a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pan card form 49a filled sample pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 49a filled example. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out pan card form 49a

How to fill out form 49a editable pdf:

01

Download the form 49a editable pdf from the designated website.

02

Open the downloaded file using a pdf reader or editor.

03

Fill in all the required information in the appropriate fields of the form, including personal details, address, and tax information.

04

Double-check the filled information for accuracy and completeness.

05

Save the filled form on your computer or device.

06

Print a hard copy of the filled form, if necessary.

Who needs form 49a editable pdf:

01

Individuals who are applying for a permanent account number (PAN) for the first time in India.

02

Individuals who are making changes or updating their existing PAN details, such as name, address, or other personal information.

03

Anyone who is required to submit PAN related documents or apply for a duplicate PAN card.

Video instructions and help with filling out and completing pan card form 49a filled sample pdf

Instructions and Help about pan card editable format

Fill pan card sample pdf download : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of form 49a editable pdf?

Form 49A Editable PDF is an Indian Income Tax form used for the purpose of obtaining a Permanent Account Number (PAN) from the Income Tax Department. It is mandatory to have a PAN for filing income tax returns and other financial transactions. The form is used to provide personal details such as address, identity proof, and other information to the Income Tax Department.

What is form 49a editable pdf?

Form 49A is an application form for Indian citizens to apply for a Permanent Account Number (PAN) card. PAN card is a unique identification number issued to individuals and entities for various financial and identity-related purposes in India.

An editable PDF of Form 49A means that the form can be downloaded and filled out digitally using a PDF editor or viewer. This allows applicants to type their information directly into the form fields, rather than having to print it out and fill it in by hand. The form can then be saved and submitted electronically or printed out and submitted physically, depending on the instructions provided by the relevant authorities.

Who is required to file form 49a editable pdf?

Form 49A (editable PDF) is required to be filed by individuals who wish to apply for a permanent account number (PAN) in India. This form is applicable for Indian citizens, Indian companies, foreign citizens, foreign companies, and other entities who require a PAN for various purposes such as taxation, identification, and financial transactions.

What is the penalty for the late filing of form 49a editable pdf?

The penalty for late filing of form 49A (Application for allotment of Permanent Account Number) in India is determined based on the Income Tax Act. Currently, the late filing fee for form 49A is Rs. 1,000 if the delay is up to December 31st of the relevant financial year. If the delay extends beyond December 31st, the penalty increases to Rs. 10,000. However, it is important to note that penalty rules and amounts are subject to change, so it's always advisable to refer to the latest guidelines or consult with a tax professional for accurate and up-to-date information.

How to fill out form 49a editable pdf?

To fill out an editable PDF form 49a, you can follow these steps:

1. Download the PDF form 49a from the official website of the Income Tax Department of India.

2. Open the form in a PDF reader that supports form filling, such as Adobe Acrobat Reader.

3. Click on the fields in the form and start typing your information. The form may include fields for your personal details, contact information, PAN (Permanent Account Number) details, and any other required information.

4. If there are checkboxes or radio buttons to select options, click on the appropriate options.

5. If there are sections that require your signature or photograph, you may need to print out the form, sign it, and attach your photograph manually.

6. If there are sections that need additional details or attachments, such as proof of address or identity documents, gather the necessary documents and scan them into digital files. You can then attach these files to the respective sections of the form by clicking on the "Attach" or "Choose File" option.

7. Once you have completed filling out the form, carefully review all the information to ensure its accuracy.

8. Save the filled-out form with a new file name or save a copy of it.

9. If you need to submit the form online, follow the instructions provided by the Income Tax Department or the relevant authority for your specific situation. If you need to submit a physical copy, print the form and submit it to the designated office or agency.

Note: It is always advisable to consult the official instructions or guidelines provided by the Income Tax Department of India or the relevant authorities before filling out any official forms.

What information must be reported on form 49a editable pdf?

Form 49A is an application form for the allotment of Permanent Account Number (PAN) in India. The following information is required to be reported on Form 49A:

1. Applicant's full name: Enter your full name, which should be the same as mentioned in your identity proof.

2. Applicant's status: Indicate your status, such as individual, company, HUF, etc.

3. Gender: Specify your gender as per the options provided.

4. Date of birth/incorporation/formation: Enter your date of birth if an individual applicant, or the date of incorporation/formation if a non-individual applicant.

5. Father's name: Provide your father's name as mentioned in your identity proof.

6. Address: Write your residential address, including your city, state, district, and PIN code.

7. Mobile number and email address: Provide your active mobile number and email address for communication purposes.

8. Aadhaar number (if available): If you have an Aadhaar card, enter your Aadhaar number. This is not mandatory for non-individual applicants.

9. Source of income: Indicate your source of income, such as salary, business/profession, house property, etc.

10. Representative Assessee (if applicable): If you want to nominate a representative assessee, provide their details.

11. Payment details: Fill in the payment details for the PAN application fee.

12. Supporting documents: Attach the necessary documents as proof of identity, address, and date of birth/incorporation/formation. The acceptable documents are mentioned on the form.

It is important to note that the information required may vary depending on the unique requirements of each applicant. The latest version of Form 49A should be referred to ensure accurate reporting of information.

How do I modify my pan card form 49a filled sample pdf in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your form 49a filled example and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make changes in form no 49a filled sample pdf?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your form 49a editable pdf to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out pan card form filling sample using my mobile device?

Use the pdfFiller mobile app to fill out and sign pan card form editable pdf. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your pan card form 49a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form No 49a Filled Sample Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to form 49a pdf

Related to pan card form fill up sample

If you believe that this page should be taken down, please follow our DMCA take down process

here

.